What Is Max Social Security Withholding 2025

What Is Max Social Security Withholding 2025 - What Is Max Social Security Withholding 2025. What is the maximum social security retirement benefit payable? The maximum $4,873 monthly benefit in 2025 is only paid to individuals who wait until age 70 to retire. The current rate for medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. 2025 social security tax limit increase in 2025, the social security tax limit rises to $168,600.

What Is Max Social Security Withholding 2025. What is the maximum social security retirement benefit payable? The maximum $4,873 monthly benefit in 2025 is only paid to individuals who wait until age 70 to retire.

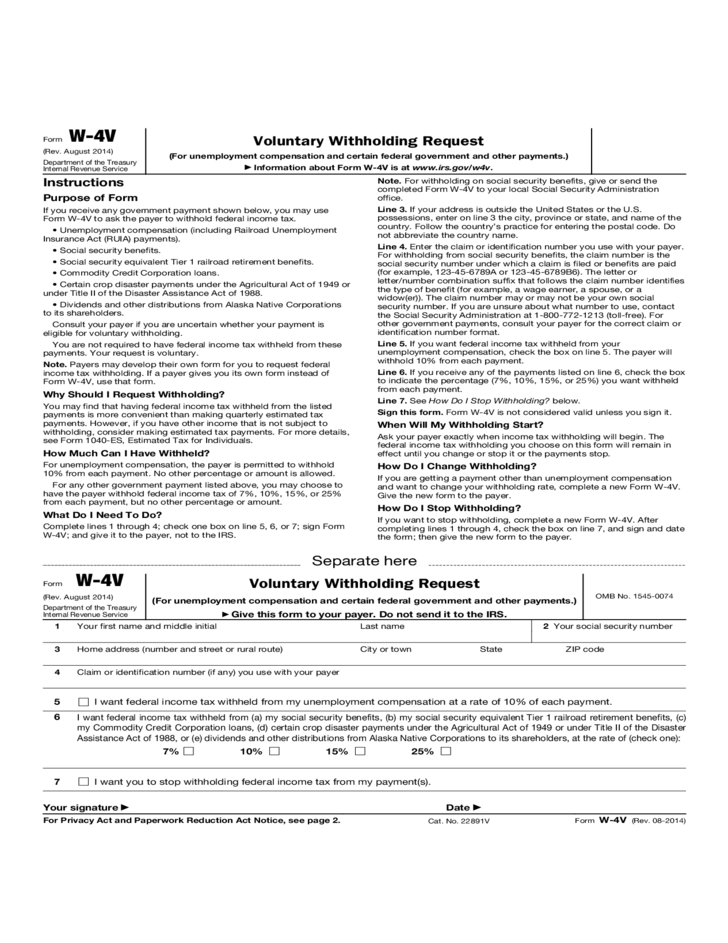

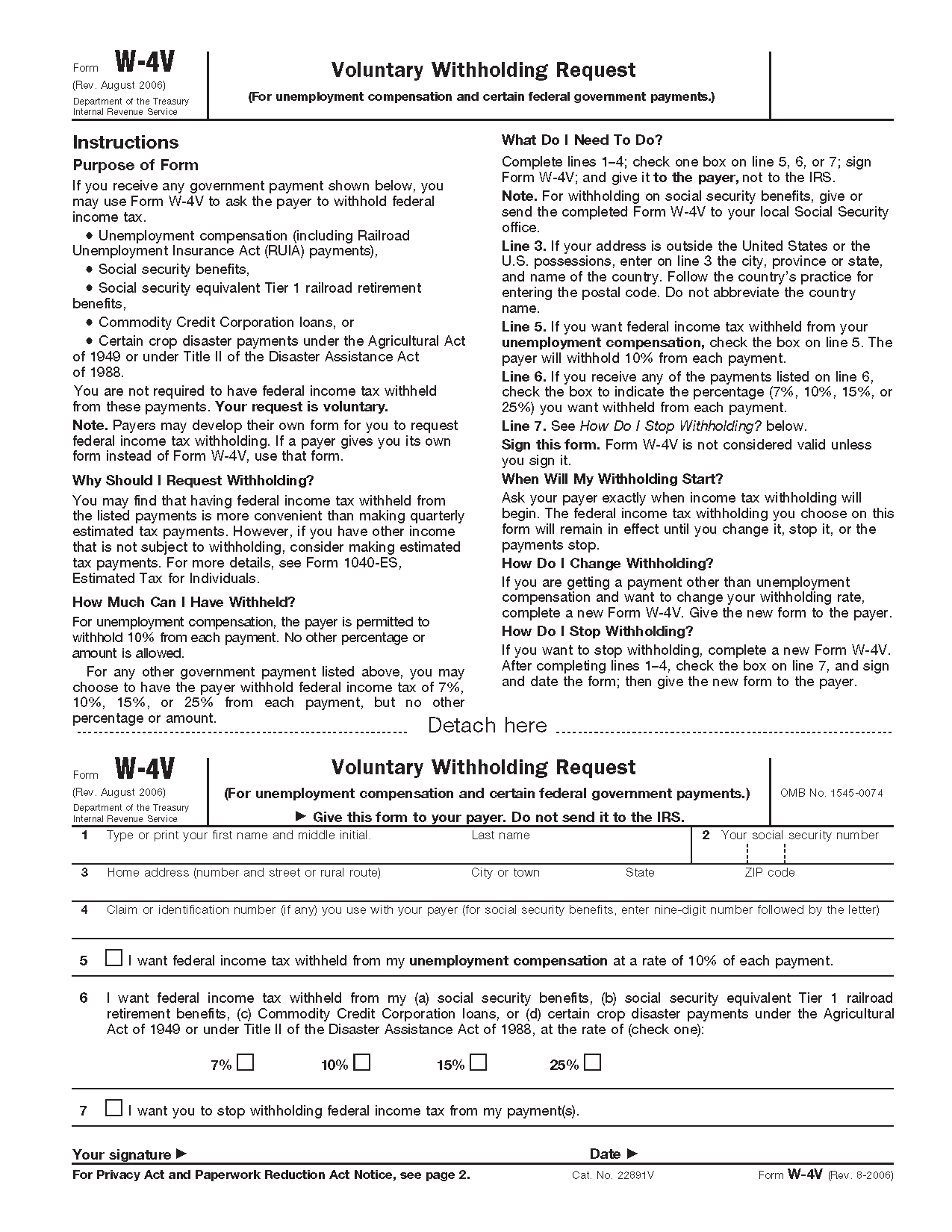

Max Social Security Tax 2025 Withholding Form Aimee Raynell, For example, if you retire at full retirement age in 2025, your maximum benefit would be $3,822.

Max Social Security Tax 2025 Withholding Form Jobey Lyndsie, The current rate for medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Maximum Social Security Tax 2025 Withholding Tax Lorne Patrice, 2025 social security tax limit increase in 2025, the social security tax limit rises to $168,600.

Maximum Social Security Benefit In 2025 Lida Sheila, The maximum benefit depends on the age you retire.

Social Security Tax Limit 2025 Withholding Tax Sonya Elianore, The maximum social security employer contribution will increase by $520.80 in 2025.

Max Social Security Tax 2025 Withholding Amount Tonia Blondie, The maximum benefit depends on the age you retire.

Maximum Social Security Tax 2025 Withholding Table Cyndi Dorelle, The maximum $4,873 monthly benefit in 2025 is only paid to individuals who wait until age 70 to retire.

What Is Max Social Security Withholding 2025 Hildy Latisha, $10,397.40 paid by each employee, and $10,397.40 paid by an employer for each employee.

2025 Social Security Maximum Withholding Marna Shelagh, Benefits in 2025 reflect subsequent automatic benefit increases (if any).

Max Ss Tax Withholding 2025 Kore Rosalie, Social security and medicare withholding rates the current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total.